I’ve hinted at my efforts to take advantage of credit card bonus offers, aka “churning” before. This isn’t a new account, but it offers cash back bonuses all the time, not just for new customers. Here’s a recent redemption from my CapitalOne Quicksilver card. I use credit cards to pay my bills, pay them before […]

Navel gazing and gratitude(ish)

Since I started EMDR therapy a few weeks ago, a lot of stuff has been coming up. As a result, it’s been hard for me to write here. Yesterday was a really tough day. I cried for most of it. I’m not depressed per se, but I have days where I cry a lot, as […]

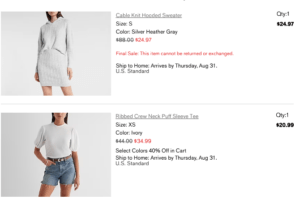

Five Frugal Things

FFT is a roundup of frugal activities I share – both to inspire you (I love reading these posts from other frugal bloggers!) and to keep myself accountable. This post contains affiliate links. This is my second FFT post in a row. I guess I’m on a roll! 😉 I got a $150 bonus from […]

Five Frugal Things

I got 80,000 bonus points on my credit card. I sometimes open a new card with a really sexy opening bonus. This time it was the Chase Sapphire Preferred Rewards card. I used it for automated bill payments and was rewarded with 80,000 bonus points (value: $800). Credit card “churning” is a fun option for […]

Single mom budgeting: How to power up your money and experience financial peace

Preview: How I do a monthly budget meeting with myself as a single mom to empower myself financially and enjoy a sense of peace around money. Despite not having any coffee that day, my heart beat so fast I felt light-headed. The mortgage papers stacked on my desk begged to be signed so the marital […]

8 captivating books I’ve devoured lately

Books are one of my favorite things in the world, and it’s high time I did a post sharing my recent reads. Here are a few of the books I’ve read in July and August. This post contains Amazon affiliate links. More info here. Wired for Love: A Neuroscientist’s Journey Through Romance, Loss, and the […]

How to pack a personal item for Spirit airlines

To save the most money on your Spirit flight, only bring a bag on board that’s 18x14x8 or smaller. Called a “personal item”, it’s the only bag you can fly with for free. Here’s how I packed my personal item for Spirit airlines for a recent 3 day weekend trip. What frugal person doesn’t respect […]

Five Frugal Things

I like to share how I’m saving money. It inspires me to read these posts by other frugal bloggers, and keeps me accountable. I got a $7 Starbucks gift card and a cute glass water bottle from Women in Money, a FinCon conference. Of course, my ticket wasn’t free. But since the information and networking […]

Tuesday Gratitude

I woke to a text from my daughter-in-love (my son’s girlfriend). She lives downstairs, in my basement apartment. She sweetly asked if I was up. Why? Because she awoke to several rooms underwater. There’s nothing quite like starting the day with a flood! It’s a yucky, helpless feeling, splish-splashing in my *Birkenstocks. Wading through the […]

The One Question That Will Change Your Life (and Finances)

(Post contains affiliate links. More info here.) One of the most important, life-changing books I’ve read is Playing with Fire: (Financial Independence Retire Early). There’s a simple exercise in the book, where you’re challenged to answer this question: What are the top 10 things that make you happiest on a weekly basis? Pretty simple. 10 […]