Preview: 14 tips on how to get out of debt as a single mom, from someone who did it herself.

In the early 2000’s, I became a single mom with four kids.

While grateful (and privileged) to be able to live with my parents while I got on my feet, it felt like a huge step backwards and injured my self-esteem. The situation wasn’t sustainable for me.

My kids and I stayed in a large bedroom, two sets of bunk beds taking up most of the floor space. To heal from the experience of my marriage, I needed to be financially independent.

Once the kids went to sleep each night, my second shift began.

I had two urgent goals.

One, eliminate my debt. Two, grow my income so I could support my four kids and move out on my own.

I accomplished both, and built an emergency fund. I now look back on this period of my life fondly, as empowering, where I made tremendous strides in personal growth.

Read on to see how I did it.

Table of contents

- Why Get Out of Debt As a Single Mom?

- How to Get Out of Debt As a Single Mom: 14 Tips

- 1: Stop charging

- 2: Smallest debt or highest interest rate?

- 3: Negotiate with your creditors

- 4: Create a large visual

- 5: Sell your stuff

- 6: Emergency fund first

- 7: Ramp up your income

- 8: Track your spending

- 9: Reward yourself for progress

- 10: Transfer balances

- 11: Educate yourself on personal finance

- 12: Go long!

- 13: Speak your goal out loud

- 14: Consider house hacking

- More posts that will help you get out of debt as a single mom:

But first.

Why is it worth it to do whatever it takes to be debt free?

Because life without debt feels amazing.

He who has a why to live for can bear almost any how.

Friedrich Nietzsche

Why Get Out of Debt As a Single Mom?

- Reduced stress – being a single mom is challenging enough without the added strain of debt.

- Improved credit scores – this can positively impact what you pay for leases, mortgages, car insurance, utilities, and more

- Increased savings potential – without debt payments, you can divert money towards savings, creating an emergency fund, saving for children’s education, or planning for retirement.

- Better quality of life – being debt-free means more disposable income, which can be used for activities and experiences that can make life richer for you and your kids.

- Financial freedom – more control over one’s finances and employment (never underestimate the power of “fuck you” money that allows you to leave a toxic marriage or job!), better decision-making and the ability to plan more easily.

- Positive financial role-modeling – improving your finances and smart money management serves as a real-life example for your kiddos that pays a lifetime of benefits

- Improved mental and physical health – getting out of debt means opportunities for better housing, increased job choices, and investments, leading to more well-being.

How to Get Out of Debt As a Single Mom: 14 Tips

Now that I’ve convinced you of the why of living debt-free, and why it’s worth short-term sacrifice and focus, let’s talk about the how.

I’ll explain exactly how I got out of debt while a single mom of four, and how I’ve stayed out in the decade-plus since.

1: Stop charging

You can’t get out of a hole unless you stop digging!

Commit to living debt-free. Imagine your life without debt and commit to that “why”.

If you don’t get this silly reference, watch the clip from Mad TV it came from. Every time you’re tempted to use your credit card, imagine a caring Bob Newhart psychiatrist telling you to “Stop it!“.

When I’d been out of debt for years and had improved my financial mindset and habits, I began using a credit card to pay my bills in order to take advantage of cash back and travel rewards. (See note at the bottom for more info.)

2: Smallest debt or highest interest rate?

Some experts insist that you should pay off the card with the highest interest rate first (called the “avalanche” method). If you’re a logical/math person and paying the higher interest rate card is more motivating to you, then do that.

Of course, there is more to getting right with money than the numbers. Part of it is the emotional aspect. I paid my smallest debt first (called the “snowball” method) for the psychological boost it gave me. The card had a small balance and getting it paid made me happy and gave me impetus to keep going.

Again, know yourself! For a discussion of the pros and cons of avalanche versus snowball methods of paying off debt, read THIS.

3: Negotiate with your creditors

You can negotiate interest rates with your creditors directly, for free, without the assistance of a consumer credit counseling service. (And you should never, ever pay someone who promises to improve your credit!)

The credit card company wants you to pay your debt and avoid bankruptcy, and remain a customer. So, they’re motivated to assist you.

Sometimes all you have to do is make a phone call, explain your financial situation, and ask for help. They might reduce your interest rate or even drop it to zero for a period of time. If the first customer service rep you talk to doesn’t help you, tactfully insist on speaking to someone who will.

There are credit counseling services that will do this for you. However, some of them charge a fee. They can also cause your credit score to drop. Read more about why this is here.

In my opinion, it’s far more empowering to create your own debt repayment plan.

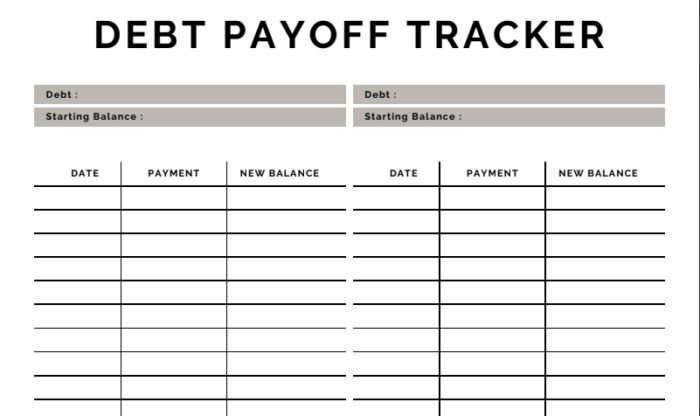

4: Create a large visual

If you’re a visual person, seeing your goal out in front of you is exciting and keeps it in the forefront of your mind.

When I was getting out of debt, I hung a large poster in my office wall with a line graph. It had lines for my debt, income and savings. It was exciting to see my savings and income grow each month (funny how that happens!) while my debt got smaller.

Download this free 3-page debt tracker to help you stay focused. Click on the image below.

5: Sell your stuff

There are lots of ways to sell stuff you don’t need, re-direct those funds towards paying off debt, and declutter in the process (which I believe helps us stay focused with a clearer mind).

Ask yourself, if you had to replace the item today, would you be willing to pay for it again? For a lot of things, the answer is no.

Your stuff can be turned into cash easily with apps like PoshMark, eBay or an old-school yard sale. I like Facebook Marketplace because there are no fees to sell locally. (Be sure to research how to stay safe when selling items this way.)

When I was getting out of debt, I got rid of things that didn’t mean a lot to me. And I disciplined myself to use that money only towards debt.

6: Emergency fund first

While this might seem backwards, starting a small emergency fund before beginning your debt payoff makes you feel safer and more in control.

The thought of getting out of debt and then having some unexpected expenses that would cause me to get right back in, was scary! Having a baby contingency fund gave me real peace of mind and increased motivation.

7: Ramp up your income

While paying off debt, I stepped up my earnings. I earn money as a blogger and internet marketer. If you are considering starting a blog or want to earn money from your blog, download my free report: 100 Top Blogging Tips here.

Other ideas for making money from home can be found here.

In addition, look into resources that are available to you on FindHelp.org. There is zero shame in getting some help when you need it.

8: Track your spending

I kept a small notebook in my purse and wrote down EVERY penny I spent, even on a pack of gum. Tracking your spending is a good money habit and a crucial part of your money routine while paying off debt.

For the same reasons tracking your food intake helps you avoid overeating, the simple act of journaling your spending will naturally curb it. It makes you more mindful, and highlights where you might be engaging in emotional spending.

I now use a free online tool called Empower to automagically track my spending (it connects to my bank accounts and credit cards). But when I was getting out of debt, doing this by hand was crucial.

If you struggle with creating a budget, check out this post: how I budget as a single mom. You can also use A.I. to help you with budgeting.

9: Reward yourself for progress

I budgeted a small amount on little treats for myself during my debt payoff, so I wouldn’t feel totally deprived.

Make a list of free treats! Examples: a good library book, a hot bath, a walk in a pretty area with a friend, a free movie from the library, a homemade hot cocoa.

Download a free “dopamenu” here with some ideas. See also: how to feel good without shopping.

10: Transfer balances

I opened a new credit card that offered zero interest for 6 months, and transferred balances on two cards. I paid it off in under 6 months.

If you’re strategic, you can beat the credit card companies at their own game. Many banks offer zero percent introductory interest on transferred balances for their new credit cards.

11: Educate yourself on personal finance

As a newly single mom, I read lots of books about debt, personal finance and emotions around money. Nearly all of them are available from the public library or the Libby app.

I also discovered some great personal finance blogs, podcasts and YouTube channels.

See more: MoneySavingMom’s Budget Book | All The Money in the World review | 17 books on personal finance | My favorite books on radical frugality | My buddy Anna Newell Jones’ excellent book, The Spender’s Guide to a Debt-Free Life.

These authors and content creators became mentors to me, and I’m still inspired by their stories.

12: Go long!

Focus on long term gain you’ll get by making short-term sacrifices.

During my debt free journey, I talked to my kids about my goals, explained what debt means, and told them what we would do once the debt was paid. This helped me not feel guilty for saying “no” to things temporarily. My kids cheered me on, knowing they’d be rewarded when we met “our” goal.

One of the things I did when I became debt-free? I bought my oldest son a guitar.

New clothing for me, and other non-essentials were also a no-no during my debt payoff. I stayed focused on what I wanted, which was to be debt-free. Sacrificing things that weren’t as important to me was worth it.

13: Speak your goal out loud

I shared my goal with others who were close to me who I knew would be supportive (this is key, be careful who you share your dreams with). Opportunities came my way because I had declared my intention.

I wrote more about my experiences as a single mom who got out of debt and lived frugally in my ebook, The Temporary Tightwad. You can get a free copy by entering your email address below.

One thing that I wish I had done differently during this time? I wish I had started investing money sooner. I use the Stash app, which allows you to begin investing with just $5. If you use this link, Stash will give you $20 free to start!

Note: this is a reader-supported site that contains affiliate links, including Amazon associates links, meaning if you click through and make a purchase, I earn a small commission. Thank you!

14: Consider house hacking

Updated for 2023: When I wrote this article initially, I was renting. Now, because I was able to build an excellent credit rating, I’m a homeowner who does “house hacking”. This helps me pay my mortgage and enjoy the tax benefits of home ownership. You can learn about house hacking here.

I first learned about house hacking from an online friend of mine, also a single mom. She bought a home with the intention of sharing her residence with a roommate. At the time, she was in college full-time. Her income was low, but she was able to rent out half the home to another single mom to pay the mortgage. They shared childcare, which made the arrangement even more beneficial.

There are lots of ways to house hack. You might be able to rent out rooms or a floor of your home, or half of it in the case of a duplex. You could rent out a trailer, RV or accessory dwelling unit on your property. Or use the Neighbor app (use my referral link for $50!) to rent out storage space in your attic, garage or other areas of your home.

Update: Years after getting and staying out of debt, I started using a credit card to pay all my bills. This makes my self-employed bookkeeping and taxes simpler, but I also get cash back and travel rewards! It’s important to have the discipline to pay off your card monthly so you never pay interest. Know thyself. If credit cards are a temptation to overspend, don’t use one! If you can utilize them for the rewards, however, I recommend doing so.

My Favorite Rewards Credit Cards

- Unlimited 1.5% cash back on every purchase, plus a $200 cash bonus with the CapitalOne QuickSilver rewards credit card – I use this card to pay for all my bills and household expenses, and enjoy getting free money in the form of cash back rewards.

- Get up to $300 for opening a SoFi checking account – this is my favorite account with a high yield savings account also available.

- Earn free travel with a Delta SkyMiles credit card – I use this one for business expenses and get free flights occasionally.

More posts that will help you get out of debt as a single mom:

- Cheap eats – how to feed a family on the cheap

- Work at home moms aren’t making the “feminine mistake”

- Motherhood, the writing life, and asking for the money

- Lowering your grocery budget

- Falling income? How to deal

- Things to do instead of shop: get happy for free

- How to stop emotional spending

- How I do budget meetings as a single mom

- The benefits of financial trauma

- How to invest small amounts of money

If you enjoyed this post, consider pinning this image. Thanks!

Hi Carrie

thanks for this blog, it would be very helpful to many if you could share the names of some of the books and blogs that helped you to learn more about debt, personal finance and emotions around money

kind regards

Caroline

Thanks Caroline. I have mentioned a couple of these books. They are:

Pay it Down by Jean Chatzky:

https://naturalmomstalkradio.com/blog/pay-it-down-by-jean-chatzky-book-review/

Money it’s Not Just for Rich People by Janine Bolon:

https://naturalmomstalkradio.com/blog/money-not-just-for-rich-people/

Savvy Saving for Busy Moms by Dar A:

https://naturalmomstalkradio.com/blog/savvy-saving-tips-for-busy-moms/

Living on Less Than $1,000 a month by Tawra Kellem:

https://naturalmomstalkradio.com/blog/living-on-less-than-1000-a-month/

That’s a lot of dedication and hard work! It all pays off in the end. Way to go Carrie.

That is an amazing feat!

We did manage to pay down our debt and save money for the down payment on our house,unfortunately after that we went back to our old ways!

It’s so easy to do once you meet a goal! My husband and I lost a few months of progress after we hit a major goal because we’re tired and just want to slide along. Big mistake though. Better to create a new goal that excites us.

Great job Carrie! These are great tips, and I can imagine how hard it is to have to get out of debt all on your own with kids!

Hi Carrie,

I like your tip on creating a visual chart of paying off your debt. I’m a visual person to. When I was getting out of debt I placed my debt schedule on my fridge. Every month I would cross out half the payment and my wife would cross out the other half…each scratch out felt amazing!

Your story is inspiring. I feel like the tips on this post would be helpful for all people who are trying to get out of debt. Love the practicality of the tips. Sure, life without debt is truly amazing.

Such great tips! I love that you still budgeted in little treats for yourself while keeping the big picture in mind. I’m saving avidly for a house and I really struggle to also reward myself for the progress I’ve made. Thank you for sharing your inspiring experience!

Thanks for reading Christine. Those little celebrations are important to help us stay motivated to meet a long-term goal.

True Hari! I think a single mom in particular would find it empowering to live a debt free life, so I shared my experience from that perspective. Appreciate your comment.

Thank you so much for this blog post. I’m in a career transition and it has been extremely difficult coming to terms with the major down shift in my income. I was led to this post at the perfect time.